Best Info About How To Buy Call Options

I start with a sample trade, and g.

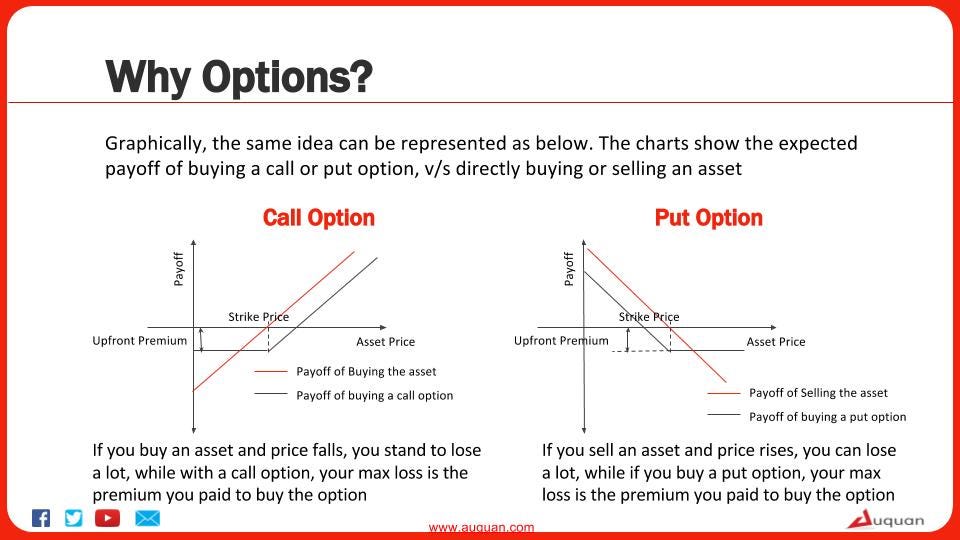

How to buy call options. Buy your call options when you are bullish. Let’s take a look at the risk profile picture of buying a call. You find a stock (or etf) you would like to buy.

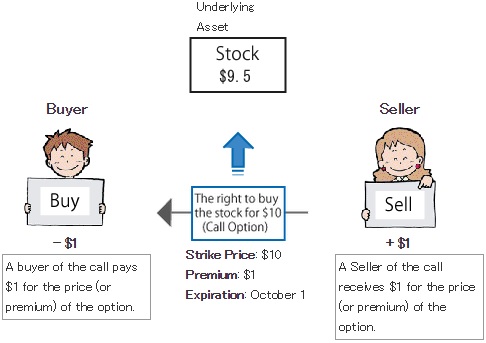

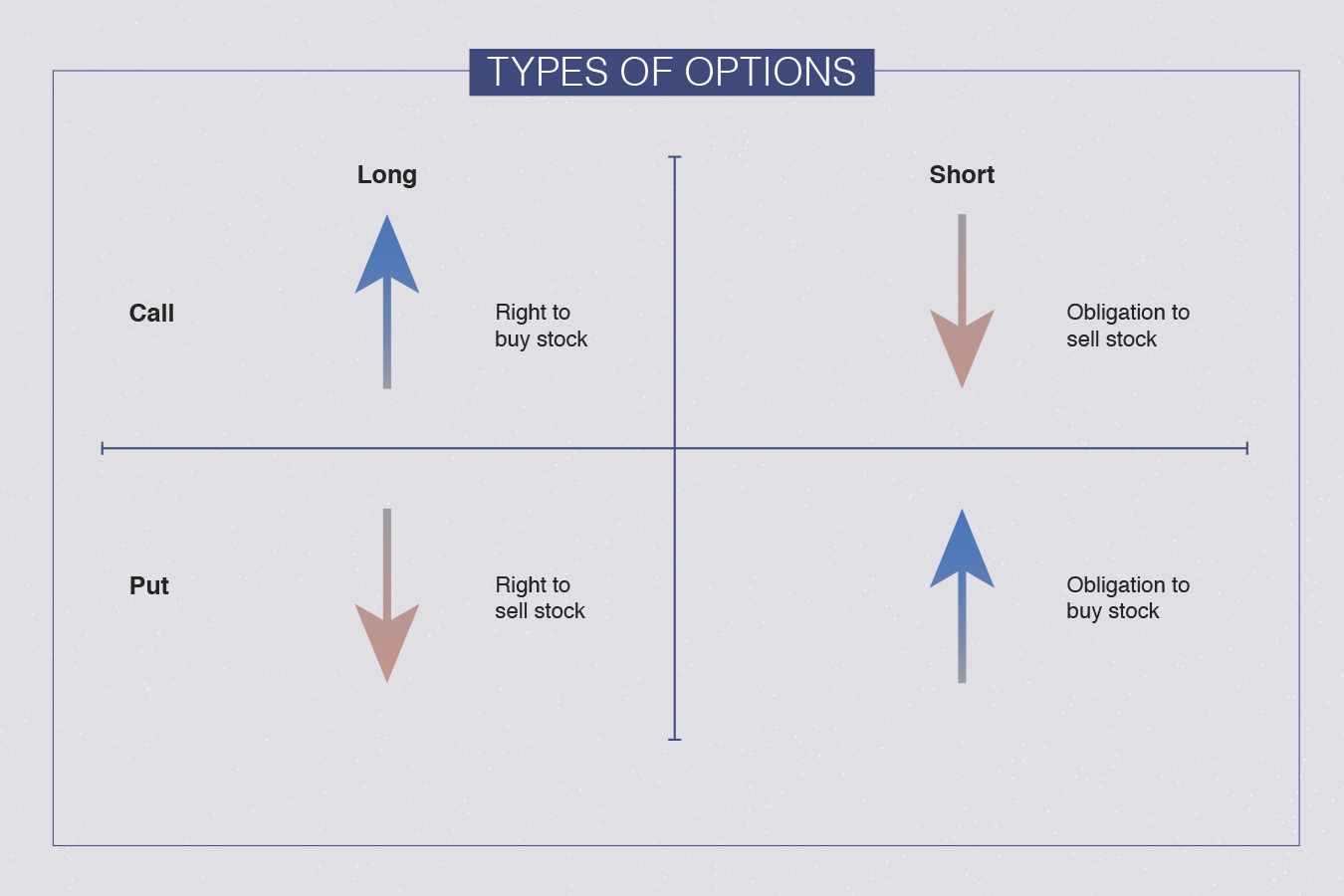

Here’s how to buy call options: There are, however, obligations that can come from writing a call options contract, as opposed to simply buying and holding a call. Call options calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price.

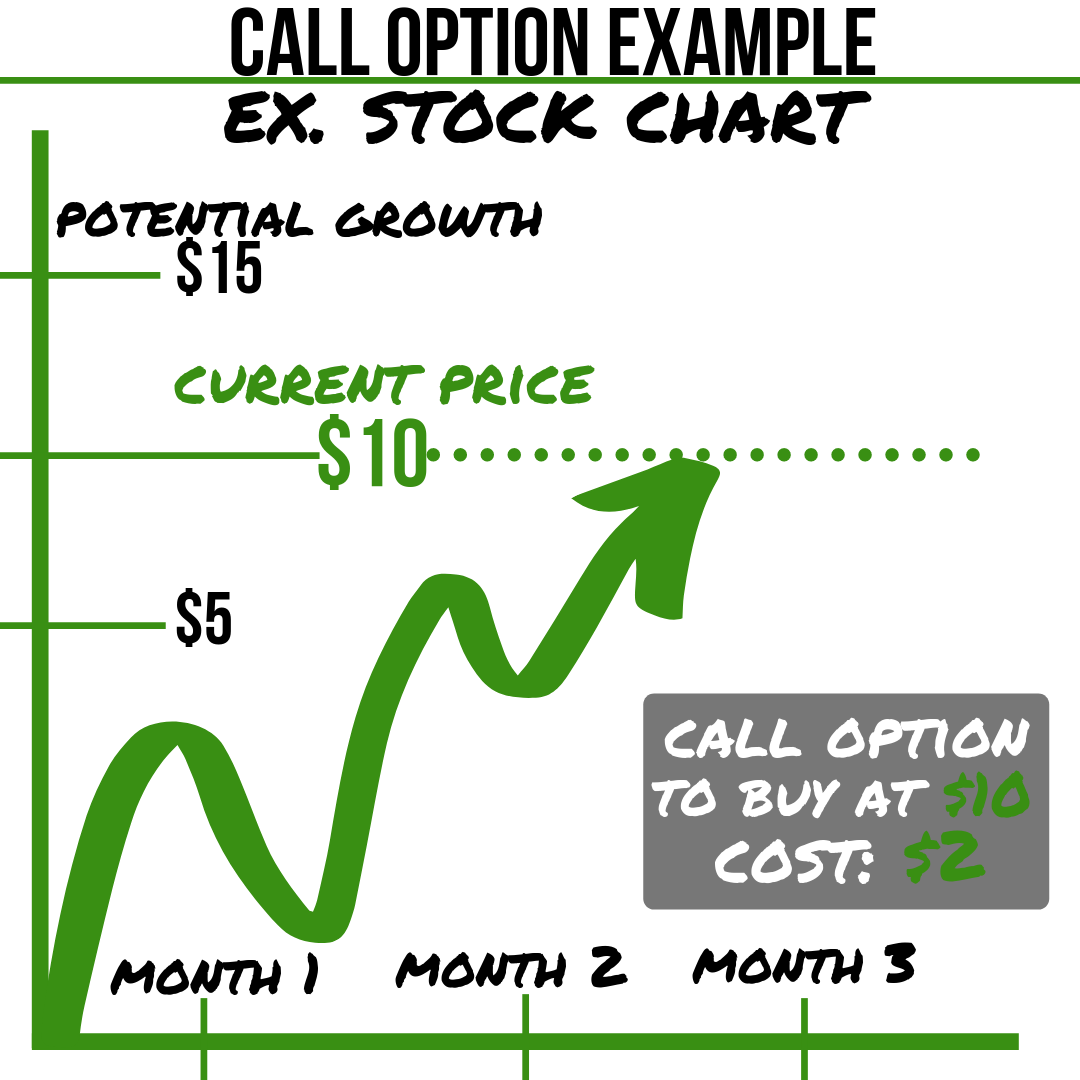

So, the total cost of buying one xyz 50 call option contract would be $300 ($3 premium per contract x 100 shares that the options control x 1 total contract = $300). Look for volume = liquidity. How to buy options in 6 steps.

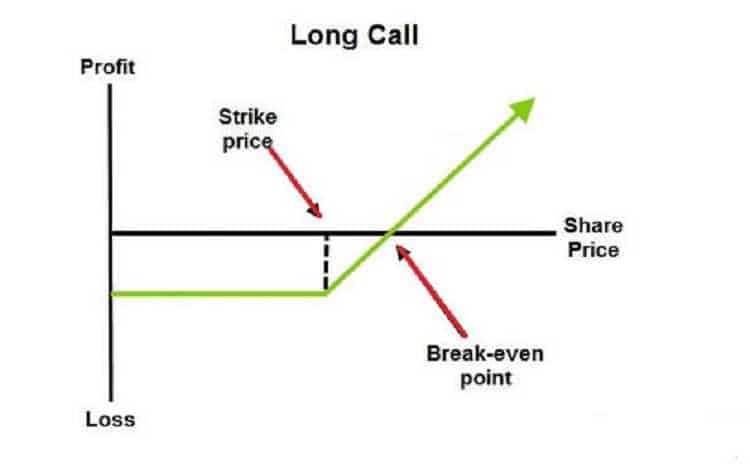

In our case, on the left side is our profit and then we have our loss based on the zero line. With this information, a trader would go into his or her brokerage account, select a security and go to an options chain. Once an option has been.

You can buy an option through a brokerage trading account. A long call is a purchased call option with an open right to buy shares. Add money to your options trading account.

What is a call option?you might have heard about option contracts in the past. Complete qualifications at your brokerage. Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

![How To Buy A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/fUNk8TjrZOA/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)