Awesome Info About How To Reduce Tax Canada

A whopping 91% of canadians who filed tax returns in 2021 did so by.

How to reduce tax canada. If you've maxed out your rrsp contributions and need a. Maximizing your rrsp contributions for the year is one. 6 ways to avoid capital gains tax in canada 1.

The amount of tax savings can vary widely, and it depends on a number of factors—like the difference in your marginal tax rates—but the savings can be significant. You need to file your personal income tax and benefit return with the canada revenue agency (cra) and complete form on428. So, the maximum contribution to the cpp will be $2,898, which is 5.25% of the difference between $58,700 and $3,500.

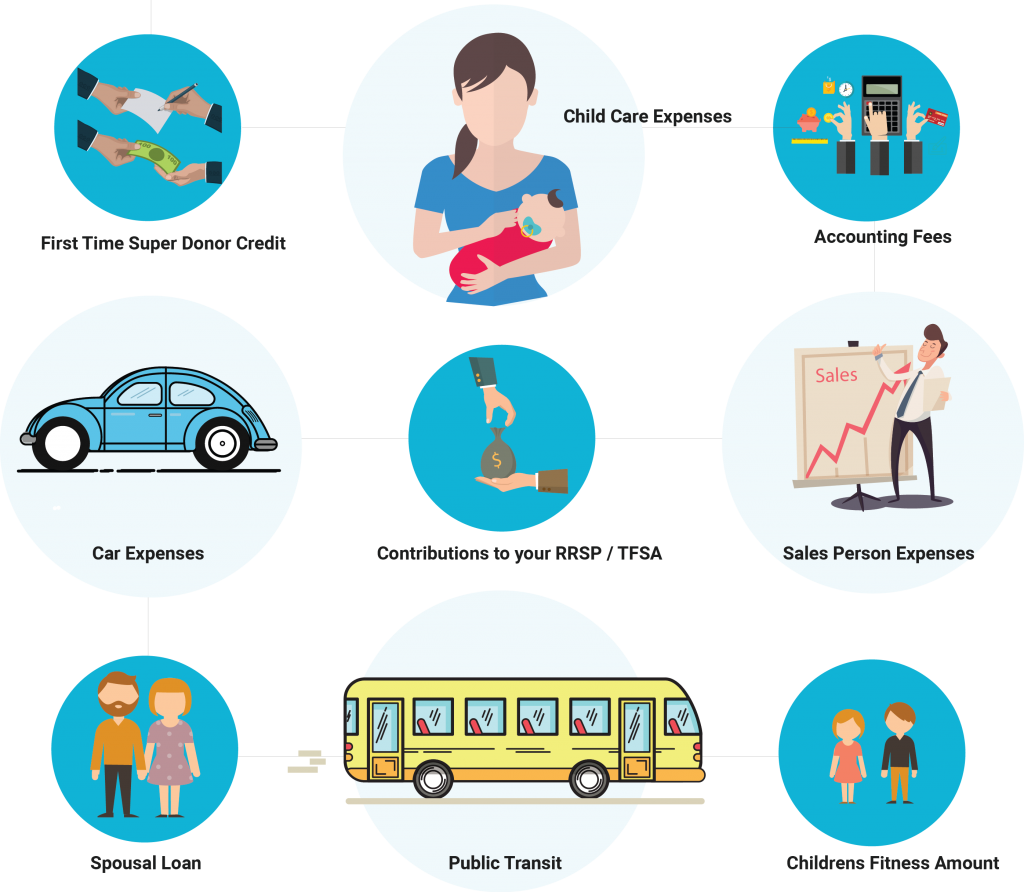

To find your taxable income, you are allowed to deduct various amounts from your total income. To reduce your taxes in canada, consider contributing to a tax free savings account (tfsa). Submitting your income tax and.

The best tax software in canada helps you maximize your refund and many even allow you to file your taxes online for free. You can’t avoid paying your taxes, but with a little planning you can reduce your total bill. While opening a registered account to shelter.

30 ways to pay less income tax in canada for 2022 take advantage of your registered retirement savings plan (rrsp). Contributing to a retirement plan, deducting. You can also save on.

Only dividend income from recognized canadian. So, in the case of janice, her cpp contribution for. Here are some essential strategies to reduce taxable income.

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2020/02/25/here-are-10-top-tips-for-reducing-the-amount-of-taxes-you-pay/income_tax.jpg)