Unbelievable Tips About How To Sell Debt

When you sell your home, you can use the equity or the property’s actual current market value to pay off the mortgage balance and closing costs associated with the sale.

How to sell debt. 1.communication with buyers and additional portfolio data. Relieve $25k+ in credit card debt or personal loan debt with this special relief program. When a debt has been purchased in full by a collection agency, the new account owner (the collector).

You want to sell the car. Just like stocks, debt trades in the secondary market. Pay off debt before you sell.

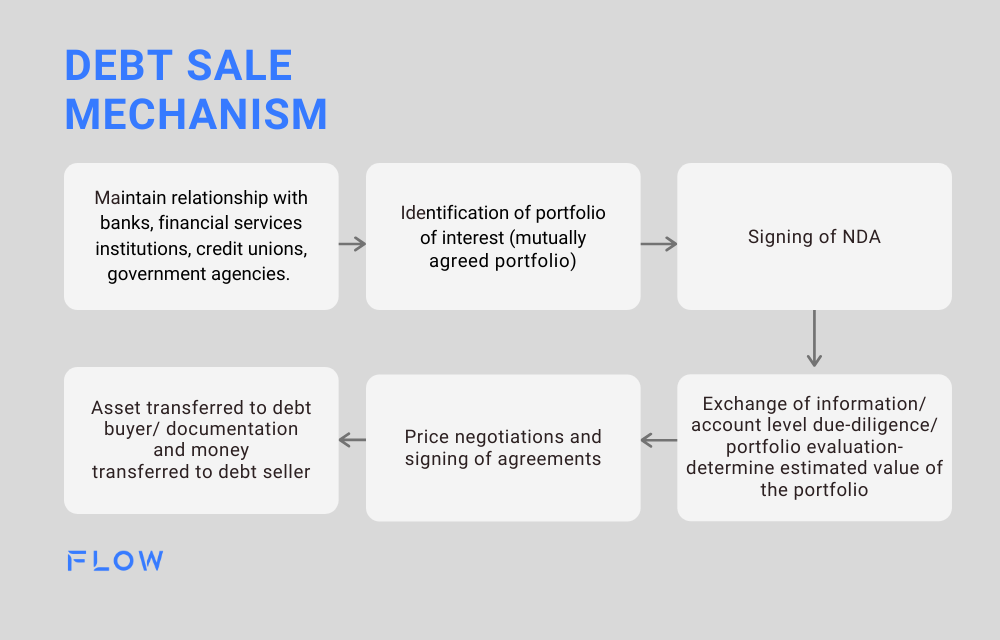

Get a stellar experience in the processes for selling debt and purchases with the debttrader platform offered by everchain uk. The majority of verified debt purchasers observe all rules and standards. Let’s suppose a lender posted a portfolio on an online platform and the trading date is about a week away.

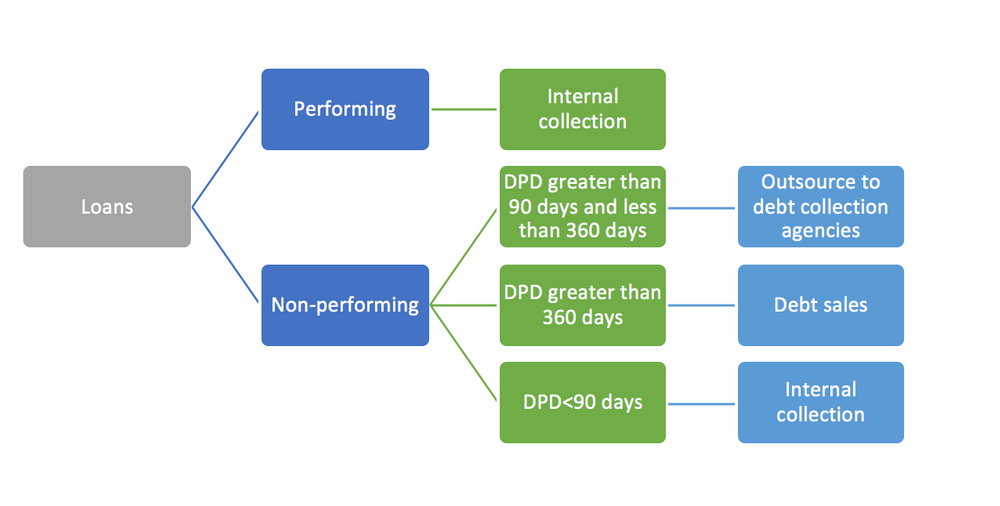

They have to pay the court fees and don't forget to. Selling debt is just like selling stock. All you need to do is start researching the types of consumer debts that you are interested in purchasing.

It trades in terms of % price of the par value or face value of the debt. For example, if you had $50,000 in your traditional. To reduce the risk, you can add a clause forbidding the resale of the debt, but this also reduces its market price.

Sell buy enlist unlimited ads for free 1. 20 hours agoa group of banks canceled efforts to sell $3.9 billion of debt that financed apollo global management inc's deal to buy telecom and broadband assets from lumen. To sell debt means to start a debt sale procedure.