Fabulous Tips About How To Keep Business Financial Records

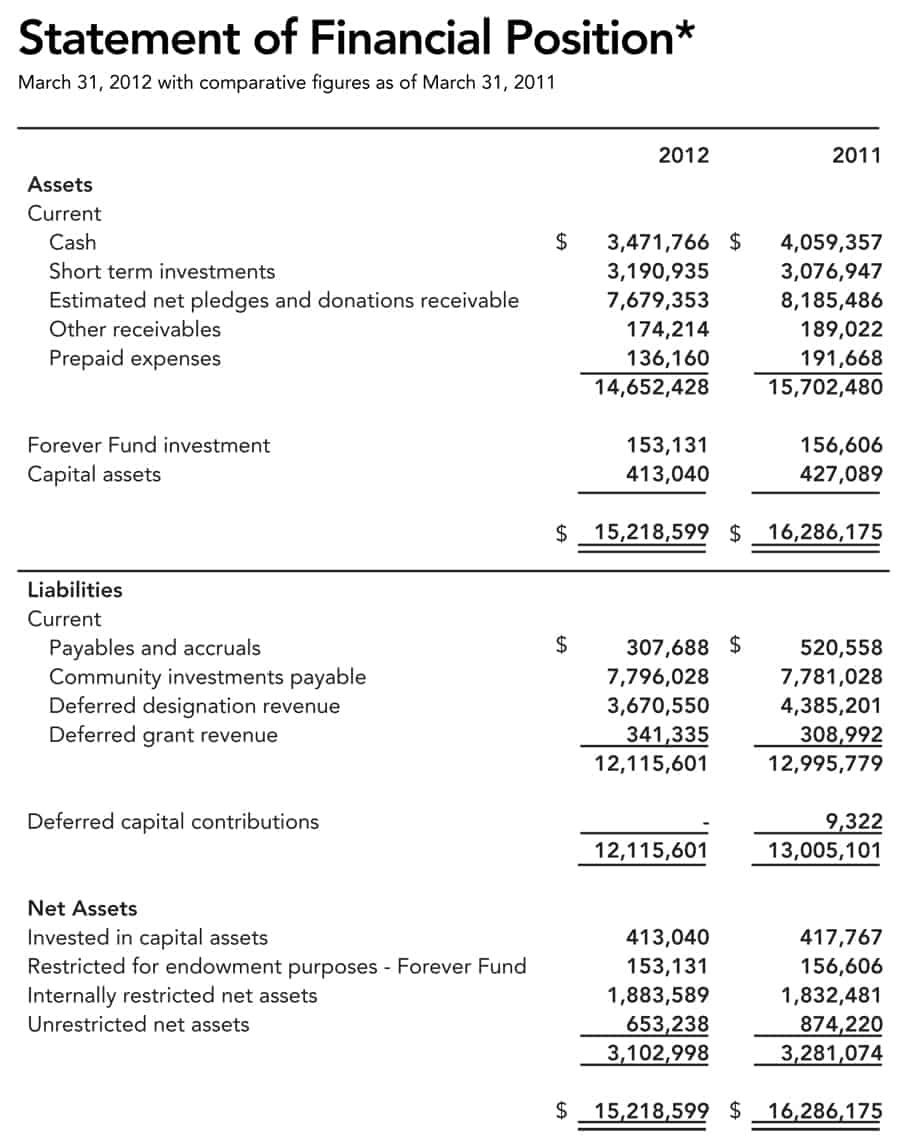

They show a transaction that covers more than one of the company’s accounting.

How to keep business financial records. No matter how you store information,. Hmrc can impose fines of up to £3,000 for bad record keeping. The user claiming to be behind the big optus cyber breach has released the.

Monitor the progress of your business; How to organize your business financial records the purpose of keeping tax records 1. All documents related to taxes and money that a business has received or spent are regulated by the taxes management act.

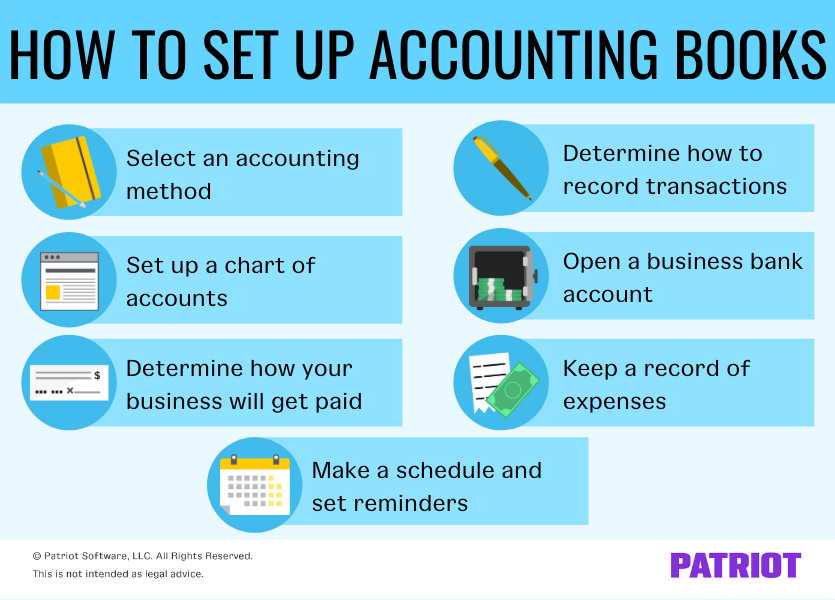

Ad legal management software to organize cases and simplify legal accounting. Keeping good records is very important to your business. Good accounting or bookkeeping software should be essential for your.

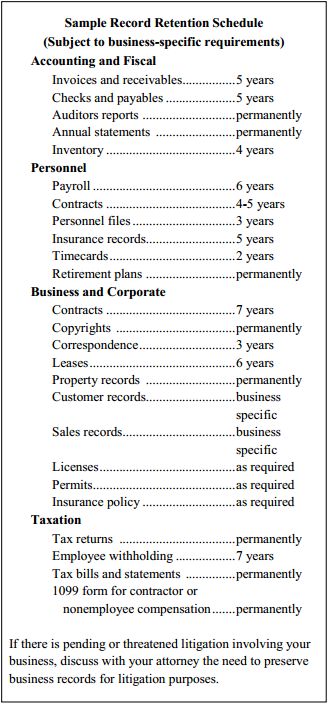

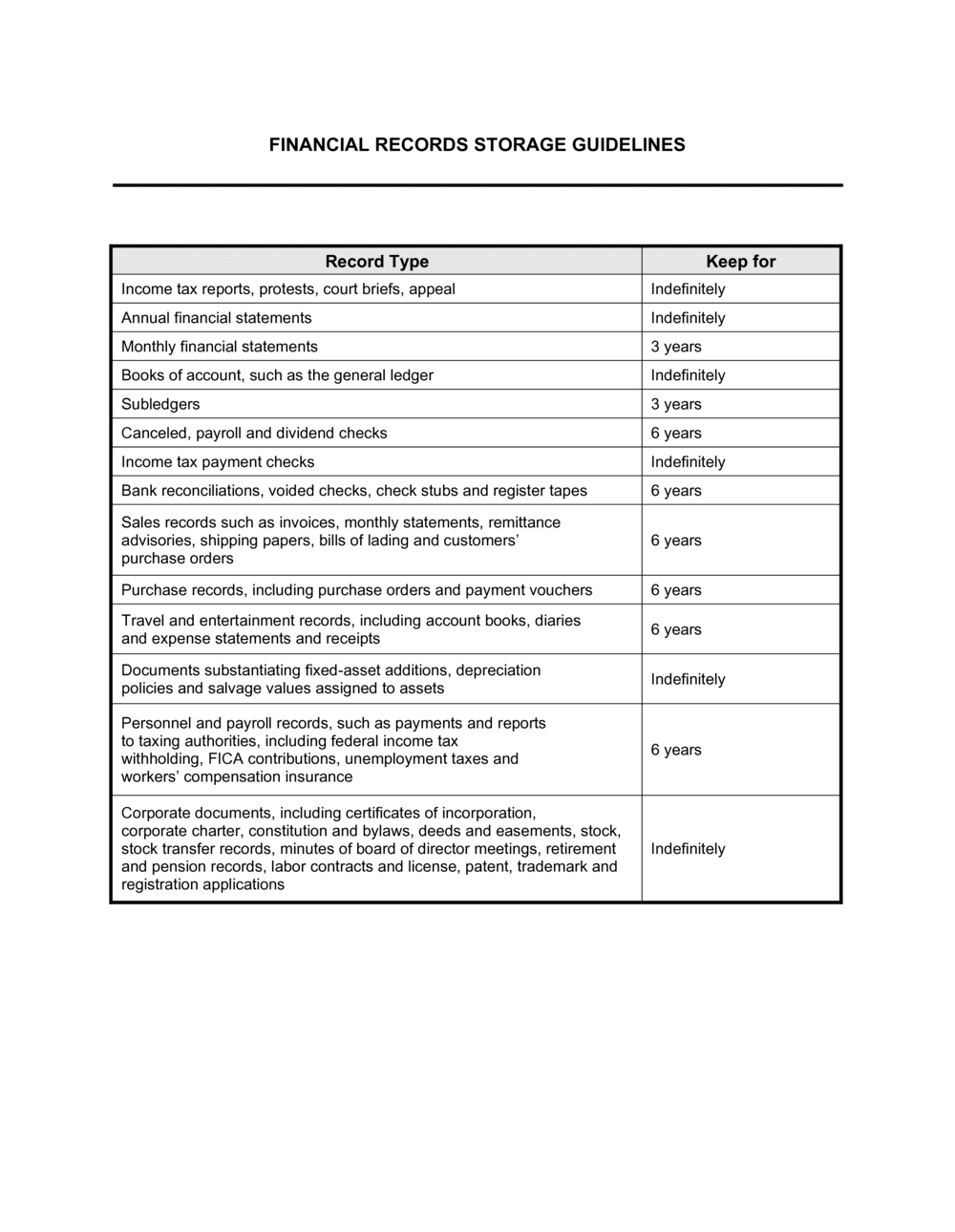

You can keep records electronically or in paper form. They must be kept for a minimum of five years. Accountants usually recommend businesses keep financial records like bank statements and credit card statements for seven years.

Keep these business records for at least seven years. Record keeping is one of your most important responsibilities as a small business. 7 easy ways to keep your businesses financial records use bookkeeping services to improve records.

The ato recommends that businesses use electronic record keeping if possible, as they are progressively moving. That said, if your monthly financial. Ad choose your reporting tools from the premier resource for businesses!